Insurance Fraud- “I think I can actually get away with this!”

Insurance fraud is a thriving multi-billion dollar industry, costing the American economy over $80 billion dollars a year. It’s not just a few bad consumers hurting a few big insurance companies either. Insurance fraud can involve falsely denied payouts and lost paperwork by insurance companies, organized crime rings crashing cars, contractors over billing, and your average Joe simply overestimating the value of his 1999 Ford convertible. Insurance fraud increases premiums for consumers and makes the whole system more costly, all thanks to a few dishonest actors.

Insurance fraud is a thriving multi-billion dollar industry, costing the American economy over $80 billion dollars a year. It’s not just a few bad consumers hurting a few big insurance companies either. Insurance fraud can involve falsely denied payouts and lost paperwork by insurance companies, organized crime rings crashing cars, contractors over billing, and your average Joe simply overestimating the value of his 1999 Ford convertible. Insurance fraud increases premiums for consumers and makes the whole system more costly, all thanks to a few dishonest actors.

Fraud is more common than people think. This is in part because when people think of insurance fraud, they think of “hard” insurance fraud, which actually represents the minority of the cases. Burning down a building or crashing a car on-purpose is what’s called “hard” insurance fraud because the source of the claim was entirely manufactured. On the other hand, “soft” insurance fraud is far more common because it consists of simply inflating the value of a legitimate claim. This type of fraud takes up the majority of an investigators time.

Data Analysis Can Flag Cases

While statistical analysis and machine learning might be making the job of flagging fraudulent claims easier for medical, automotive, and general insurers, but the job of actually investigating insurance fraud still falls in the lap of specialized professionals like private investigators. When a potentially fraudulent claim comes across an investigator’s desk they have a wide variety of tactics they can employ, from old school stakeouts to advanced research to gathering evidence to justify denying a claim, or even bring legal action against a claimant.

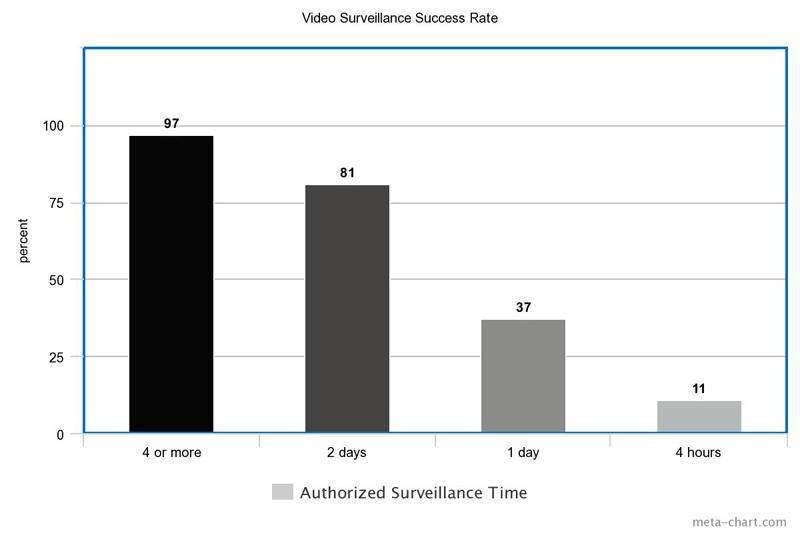

Stakeouts and Surveillance are Still Important Ways of Catching People

Why is surveillance so important? Surveillance can make sure someone’s claims are backed up by their behavior. If someone is claiming an injury, then their lifestyle and daily actions should be consistent with that. When it’s not (as was the case when we watched the individual claiming a severe back injury helping his friend move his belongings into a moving truck), you most likely have a case of fraud, and surveillance can provide compelling evidence of that. Well trained Private Investigators know how to conduct this type of surveillance legally, safely and discreetly.

Social Media Can Be Used To Catch Fraudsters- “Check out my skiing vacation pics!”

![]() You’d think that people engaged in fraud would be extra careful, but you would be wrong. From boasting about fraudulent claims to posting photos of themselves skiing while claiming a leg injury, you would be shocked with how often people post incriminating evidence publicly on social media. This makes social media investigators an incredibly valuable tool to an insurance company’s arsenal.

You’d think that people engaged in fraud would be extra careful, but you would be wrong. From boasting about fraudulent claims to posting photos of themselves skiing while claiming a leg injury, you would be shocked with how often people post incriminating evidence publicly on social media. This makes social media investigators an incredibly valuable tool to an insurance company’s arsenal.

However, sometimes things get a little more complicated than simply screenshotting some photos. For every person uploading damning pictures and statuses, there are people with enough smarts to attempt to hide evidence of their wrongdoing. Fraudsters have been known to create fake social media accounts to hide their actions, or up their privacy settings in hopes of avoiding scrutiny.

If you have an Insurance Fraud case you would like to discuss, contact Blackstone Investigations Group, LLC today! CALL US TODAY so we can catch these knuckleheads!